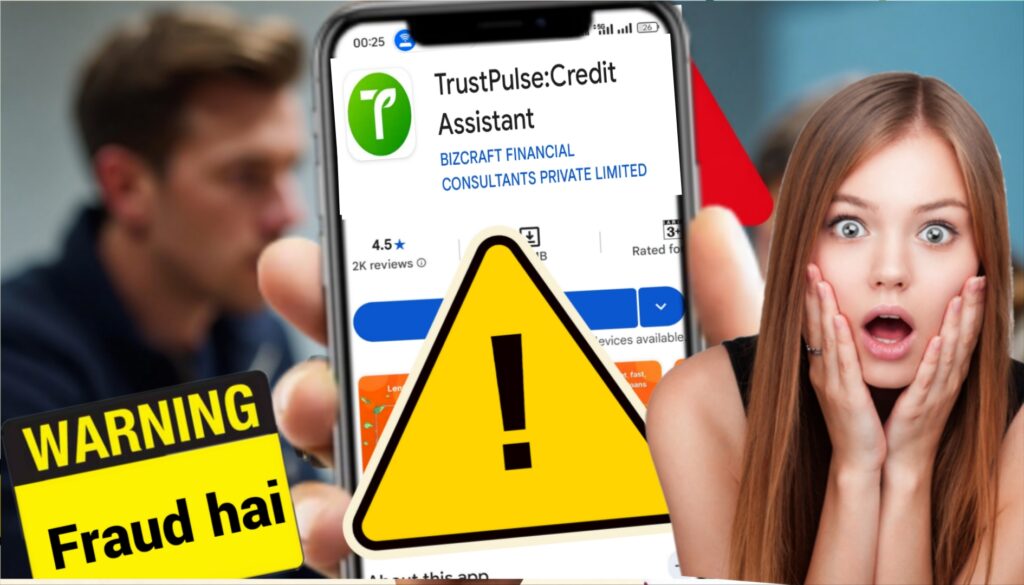

TrustPulse: Credit Assistant Loan App –TrustPulse Loan Real or Fake

Aaj kal bahut saare log urgent paise ki zaroorat mein instant loan apps download kar lete hain. Ek aisa hi app hai TrustPulse: Credit Assistant (Play Store link: https://play.google.com/store/apps/details?id=com.verycredit.getscore ya similar ID wala). Ye app claim karta hai ki ye credit score check karne, personal loan dene aur easy approval wala tool hai. Lekin real users ke reviews aur complaints dekh kar lagta hai ki ye ek typical 7-day short-term loan app hai jo bahut heavy interest aur hidden charges lagati hai, aur users ko trap mein fasati hai.

Important Warning: Is app ke official description aur positive reviews pe bilkul bharosa mat karna. Bahut se positive reviews fake lagte hain – jaise scripted, repetitive words use karte hain (smooth interface, fast approval, no hidden fees, transparent etc.). Real critical reviews Play Store pe aur Google Play Community mein bahut serious complaints dikha rahe hain.

TrustPulse Credit Assistant Kya Hai? (App Overview)

Ye app short-term loans offer karta hai, mostly 7 days ke liye. Matlab aap 2000-5000 Rs tak borrow kar sakte ho, lekin repayment 7 din mein karna padta hai. App ka naam “TrustPulse: Credit Assistant” hai, aur ye credit score improve karne ka bhi claim karta hai, lekin asal mein ye predatory lending style follow karta hai.

- Claimed Features (App Description Se): Fast approval, easy application, transparent fees, good customer service, privacy protection.

- Reality (Users Ke According): Unauthorized loan disbursement (bina full consent ke paise transfer), extremely high interest (ek chhote loan pe 10x-20x wapas karna padta hai), harassment calls/messages, blackmailing with morphed nude photos ya contacts ko threaten karna.

Ye typical Chinese ya foreign-operated loan apps ki tarah behave karta hai jo India mein illegal ya unregulated hote hain. RBI registered nahi lagta properly, ya agar hai bhi to rules follow nahi karta.

Critical Reviews Jo Play Store Pe Mil Rahe Hain (Real User Experiences)

Users ne bahut serious baatein likhi hain February 2026 ke around:

- Swapnil Pawar (13/02/26, 1-star): “One of the worst app without customer consent they approve the application and transfer the money… after paying they do the same thing by approving the loan again… happened twice… I have to pay extra 2k each time… need clear explanation or will report to RBI.” (88 logon ne helpful bola)

- Chandanan Rajbhar (17/02/26, 1-star): “Made a mistake and took Rs 4500 loan… but company forcibly gave expensive loan… have to pay Rs 40,800… paid some but unable to pay remaining.” (27 helpful)

- Sunoj Munnar (14/02/26, 1-star): “When we give details, they credit money instantly without concern (eg: for 3500 they credit only 2100)… repayment tenure fixed for 7 days… on sixth day they start calling continuously, threatening… after repayment, next day ask to pay again… if refuse, send our nude pictures… please don’t install this Bangladesh app.” (5 helpful)

Ye reviews dikha rahe hain ki app:

- Bina poocha paise daal deta hai (ghost disbursement).

- Deduct karke kam paise deta hai, lekin full + heavy interest maangta hai.

- 7-day tenure ke baad harassment shuru – calls, messages, blackmail with photos (real ya morphed).

- Repay karne ke baad bhi repeat loans force karne ki koshish.

Positive reviews jaise Ashu Rana, Lavekush Rathour, AA AA wale – ye sab bahut polished language use karte hain, jaise copy-paste. Inme helpful votes bahut kam (3-0), jabki negative pe 80+ log agree kar rahe.

YouTube pe bhi videos hain jaise “TrustPulse Credit Assistant Loan App Review Real Or Fake? || Harassment and Blackmailing” – jahaan log warn kar rahe hain.

Kyun Heavy Charges Lagte Hain? (7-Day Loan Trap Explained)

Ye apps 7-day short tenure pe kaam karte hain:

- Aap Rs 3000 maangte ho → Processing fee, GST, insurance etc. deduct karke Rs 2000-2500 hi milta hai.

- Repay karna padta hai Rs 5000-10000+ (interest 100-500% effective annual rate, lekin short term mein bahut zyada lagta hai).

- Miss karo to daily penalty + harassment.

- Trap: Repay karne ke baad automatically new loan approve aur disburse, forcing you to pay more.

RBI ke rules ke according, NBFC ya banks ko fair practices follow karni chahiye – no harassment, no privacy breach. Lekin ye apps aksar ignore karte hain.

Agar Aap Is App Ke Trap Mein Fas Chuke Ho Toh Kya Karein? (Complaint Kaise Karein)

Agar aapne already loan liya hai aur harassment ho raha hai (calls, threats, photos share karne ki dhamki):

- Sabse Pehle Police Cyber Cell Mein Complaint File Karo:

- Nearest Cyber Crime Police Station jaao ya online portal pe report karo: https://cybercrime.gov.in

- Details do: App name, transaction proofs, screenshots of messages/calls, bank statements.

- Blackmailing/privacy breach ke against IPC sections 354D, 509, 66E etc. lag sakte hain.

- RBI Ombudsman Ya Sachet Portal:

- RBI ke paas complaint karo agar app RBI-registered claim karta hai: https://cms.rbi.org.in

- Ya https://sachet.rbi.org.in pe unauthorized lending report karo.

- Google Play Store Pe Report Karo:

- App page pe jaake “Report inappropriate app” → Fraud ya Harassment select karo.

- Bank Se Help Lo:

- Transaction reverse karwane ki koshish karo (fraud chargeback).

- Helplines:

- National Cyber Crime Reporting Portal: 1930 call karo.

- Women Helpline (if applicable): 181 or 1091.

Bahut se cases mein logon ne cyber complaint karke harassment rukwaya hai. Suicide tak cases hue hain aise apps ke wajah se, toh jaldi action lo.

FAQ – TrustPulse Credit Assistant Loan App Ke Baare Mein Common Questions

Q1: TrustPulse Credit Assistant app safe hai kya?

A: Nahi bilkul safe nahi. Bahut saare users ne unauthorized loans, high charges, aur blackmail ki complaints ki hain. Positive reviews fake lagte hain.

Q2: Ye 7-day loan app hai? Interest kitna lagta hai?

A: Haan, mostly 7 days tenure. Interest bahut heavy – small loan pe bhi 5-10x wapas maangte hain effective.

Q3: App description achha hai, phir problem kyun?

A: Description marketing ke liye hai. Real picture critical 1-star reviews mein dikhti hai – harassment, forced loans, privacy leak.

Q4: Loan repay na karne pe kya hota hai?

A: Continuous calls, threats, contacts ko messages with morphed nude photos bhejna – ye common tactic hai illegal loan apps ka.

Q5: Complaint kahan karun agar fas gaya hoon?

A: Cybercrime.gov.in pe report, RBI Sachet, local police. Proofs rakho – screenshots, bank txn, messages.

Q6: Kya ye RBI approved hai?

A: Doubtful. Bahut se aise apps fake registration claim karte hain. RBI list check karo official site pe.

Q7: Alternative kya use karun safe loan ke liye?

A: Banks jaise SBI, HDFC apps, ya RBI-registered NBFCs (PaisaBazaar, MoneyTap etc.) – low interest, no harassment.

Final Advice

TrustPulse: Credit Assistant jaise apps se door raho. Urgent need ho to family/friends se madad lo, ya legal sources use karo. Ek chhota loan life barbaad kar sakta hai – harassment, mental stress, financial loss.

Agar aap is app ke victim ho, toh abhi complaint karo. Share karo ye article apne doston ke saath taaki koi aur na fase