New Loan App 2025: Aapke Quick Money Needs Ka Solution

Aajkal ki fast life mein kabhi bhi financial emergency aa sakti hai, aur aise mein ek reliable aur quick loan app hona bohot zaroori hai. 2025 mein ek naya loan app kaafi popular ho raha hai, jo instant credit dene ka waada karta hai. Is article mein hum is app ke features, benefits, aur real user reviews ke baare mein baat karenge, aur last mein iska naam reveal karenge—thoda suspense toh banta hai! Agar aap student hain, young professional hain, ya urgent funds ki zaroorat hai, toh yeh app aapke kaam aa sakta hai. Chalo, is app ke baare mein detail mein jaante hain, aur dekhte hain ki yeh sach mein useful hai ya nahi.

Yeh New Loan App Kyun Hai Khaas?

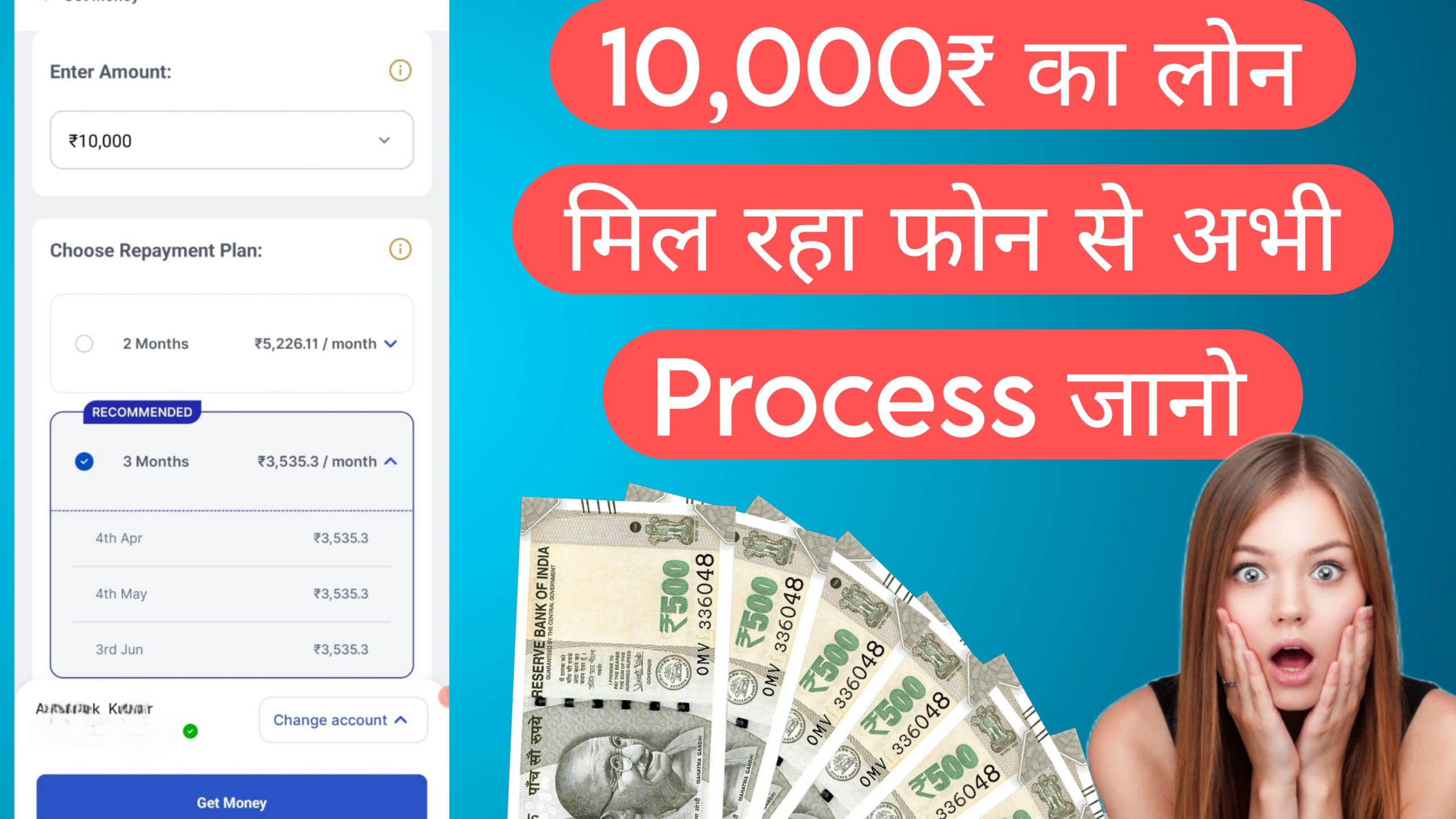

Yeh loan app modern users ke liye banaya gaya hai, jo chhote aur short-term loans ke liye ek easy digital solution chahte hain. App ke interface mein dikh raha hai ki iska total credit limit ₹10,000 tak hai, jo un logon ke liye perfect hai jo emergency ke liye quick cash chahte hain, bina zyada paperwork ke. App ka design bohot user-friendly hai—bas kuch clicks mein aap loan ke liye apply kar sakte hain. Iske saath hi, yeh app credit bureaus jaise Experian ke saath integrate karta hai, jisse aapko apna credit score pata chal sakta hai. Jaise ki interface mein dikh raha hai, user ka score 607/900 hai—jo ek decent score hai—aur isse aap apni financial health track kar sakte hain.

Ek bada feature hai iska “Get Money” option. Isse aap loan approve hote hi turant paise withdraw kar sakte hain. Repayment structure bhi flexible hai—jaise ki yahan dikh raha hai, ₹3,535.3 har mahine 4th April, 4th May, aur 3rd June ko due hai, yeh teen installments mein spread hai. Lekin, kuch extra charges bhi hain jo dhyan rakhne zaroori hain. Processing fee 7.20% hai (₹720.35), GST 1.30% (₹129.65), aur 3% monthly interest (₹605.9) bhi add hota hai. Toh, agar aapko ₹9,150 disbursal amount milta hai, toh total repayment ₹10,605.9 ho jata hai. Yeh charges app mein clearly dikhaye gaye hain, jisse aapko pata hota hai ki aap kya pay kar rahe hain.

Is app mein ek aur interesting feature hai—”Get a Chance to Increase Your Credit Limit.” Agar aap pending documents complete karte hain, toh aapka credit limit badh sakta hai instantly. Plus, ek limited-time offer bhi hai jismein aap iPhone 16 jeet sakte hain—yeh toh bohot exciting hai! App ke dashboard mein Home, My Loans, aur Dashboard jaise options bhi hain, jisse navigation aur use karna bohot asaan ho jata hai.

Real Users Ke Experiences: Achha, Bura, Aur Bekaar

App ke features toh kaafi promising lagte hain, lekin asli picture toh user reviews se hi pata chalta hai. Kuch users ko yeh app pasand aaya, lekin kaafi logon ne serious issues bhi share kiye hain. Chalo dekhte hain kya kehna hai users ka:

- Payment Mein Dikkat: Ek user, Akash Tiwari, jo 2 saal se app use kar rahe hain, ne bataya ki payment karte waqt bohot issues aate hain. Kabhi payment “pending” dikhata hai, kabhi “already paid,” aur is wajah se woh due date se pehle payment nahi kar paate. Due date ke baad payment karne par extra late charges lagte hain, aur yeh baat unhe bohot pareshan karti hai. Woh kehte hain ki jab support team se contact kiya, toh koi response nahi mila. Unhone toh app ko “scam” tak bol diya—yeh toh serious baat hai.

- KYC Verification Ka Jhanjhat: Do users, Muingsa Limboo (15th April 2025) aur Rishabh Adhikari (9th April 2025), ne Video KYC process ke baare mein complaint ki. Dono ne bataya ki KYC complete karne mein bohot dikkat aa rahi hai—process bar-bar fail ho raha hai, aur customer support se koi help nahi mil rahi. Support team bas yahi bolta hai ki “humare executives busy hain,” aur users ke mails ka bhi koi jawab nahi dete. Yeh issue un logon ke liye bada problem hai jo urgent money ke liye app use kar rahe hain.

- Loan Deny Karna: Bipul Sharma (22nd April 2025) ne bataya ki unhone apna credit limit badhaya aur saare loans repay bhi kar diye, lekin jab naye loan ki zaroorat padi, toh app ne error dikhaya aur loan nahi diya. Unhe yeh baat bilkul pasand nahi aayi ki jab unhe paison ki sakht zaroorat thi, tab app ne unhe disappoint kiya. Yeh inconsistency users ke trust ko tootne ka kaaran ban sakta hai.

- Privacy Ka Risk: Ek user, Dattatraya Paul (26th April 2025), ne toh app ko “worst aur suspicious” bol diya. Unka kehna hai ki app ne unke personal details jaise video, IDs, aur numbers collect kiye, lekin last mein loan process nahi kiya. Unke friends ke saath bhi yahi hua, aur unhone cyber authorities ko report bhi kar diya. Unhone warning di ki is app par trust na karein—yeh toh bohot bada red flag hai.

Yeh App Aapke Liye Sahi Hai Ya Nahi?

Agar aapko chhote, short-term loans chahiye aur aap digital platforms ke saath comfortable hain, toh yeh app aapke kaam aa sakta hai. Credit bureau integration, transparent fee structure, aur iPhone 16 jeetne ka offer jaise features isse attractive banate hain. Lekin, user reviews ko dekhte hue, kuch baatein dhyan rakhni zaroori hain. Customer support ka poor response, technical glitches, aur privacy concerns jaise issues serious hain. Agar aap is app ko use karna chahte hain, toh fees jaise 3% monthly interest aur processing charges ke liye ready rahiye, aur agar technical issues aaye toh backup plan rakhein.

Yeh App Hai Kya? Chalo Reveal Karte Hain!

Ab suspense khatam karte hain! Yeh jo app hum baat kar rahe the, woh hai Pocketly—ek loan app jo 2025 mein India ke fintech space mein kaafi naam kama raha hai. Pocketly chhote loans ke liye ek promising option hai, lekin iske reviews se pata chalta hai ki ismein abhi bohot improvement ki zaroorat hai, khaas kar customer support aur reliability ke mamle mein. Agar aap 2025 mein ek loan app try karna chahte hain, toh Pocketly ek option ho sakta hai, lekin thoda careful rehna zaroori hai. Apne needs ke hisaab se pros aur cons ko dhyan mein rakhein, aur tab decide karein ki yeh app aapke liye sahi hai ya nahi.

Pocketly Ke Pros Aur Cons Ek Nazar Mein

Pros:

- Quick aur easy loan process.

- Credit score tracking ke liye Experian integration.

- Transparent fees aur charges.

- Credit limit badhane ka option.

- Exciting offers jaise iPhone 16 jeetne ka chance.

Cons:

- Customer support ka poor response.

- Payment aur KYC process mein technical glitches.

- Privacy concerns—personal data collect karne ke baad loan deny karna.

- Loan approval inconsistency, jisse emergency mein problem hoti hai.

Pocketly Ko Kaise Use Karein?

Agar aap Pocketly try karna chahte hain, toh steps bohot simple hain:

- App download karein aur sign up karein.

- Apna KYC complete karein (haan, yeh thoda tricky ho sakta hai, toh patience rakhein).

- Apna credit limit check karein aur loan ke liye apply karein.

- Loan approve hone ke baad “Get Money” option se paise withdraw karein.

- Repayment schedule ko dhyan se follow karein, taaki extra charges se bacha ja sake.

Aakhri Baat: Pocketly 2025 Mein Kaisa Perform Kar Raha Hai?

Pocketly ek aisa app hai jo quick loans ke liye banaya gaya hai, aur iska target young crowd hai jo instant money chahta hai. Lekin, user reviews se yeh clear hai ki app mein abhi kaafi bugs aur issues hain, jo user experience ko kharab karte hain. Agar Pocketly apne customer support aur technical issues ko fix kar le, toh yeh 2025 ka ek popular loan app ban sakta hai. Filhaal, agar aap isse use karna chahte hain, toh thoda risk ke saath ready rehna padega. Apne options ko dhyan se dekhein, aur tab decide karein ki kya yeh app aapke liye fit hai ya nahi.