Creditrack Credit Assistant Loan: नई लोन ऐप जो मदद के नाम पर ठगी- सावधान रहें

हाल ही में गूगल प्ले स्टोर पर एक नई लोन ऐप “Creditrack Credit Assistant” लॉन्च हुई है, जो दावा करती है कि यह आपके क्रेडिट स्कोर को बढ़ाने में मदद करेगी। लेकिन क्या यह वाकई आपकी फाइनेंशियल हेल्प के लिए बनी है, या फिर यह एक छिपा हुआ ठगी का जाल है? यूजर्स के अनुभव और इस ऐप की कार्यप्रणाली को देखते हुए यह साफ होता है कि यह एक शॉर्ट-टर्म लोन ऐप है, जो हाई इंटरेस्ट रेट्स के साथ लोगों को फंसाने का काम कर रही है। आइए, इस ऐप की हकीकत को गहराई से समझते हैं और जानते हैं कि आपको इससे क्यों सावधान रहना चाहिए।

Creditrack Credit Assistant क्या है?

Creditrack Credit Assistant अपने आप को एक क्रेडिट स्कोर सुधारने वाली सर्विस के रूप में पेश करती है। यह यूजर्स को लुभाने के लिए आकर्षक वादे करती है, जैसे कि आसान लोन अप्रूवल और क्रेडिट स्कोर में सुधार। लेकिन असल में यह एक 7-दिन की अवधि वाला लोन प्रोवाइड करती है, जिसमें बेहद ऊंची ब्याज दरें और छिपे हुए चार्जेस शामिल हैं। यूजर्स का कहना है कि यह ऐप उनके फाइनेंशियल हेल्थ को बेहतर करने के बजाय उन्हें कर्ज के जाल में फंसा रही है।

यूजर्स का अनुभव: ठगी का खुलासा

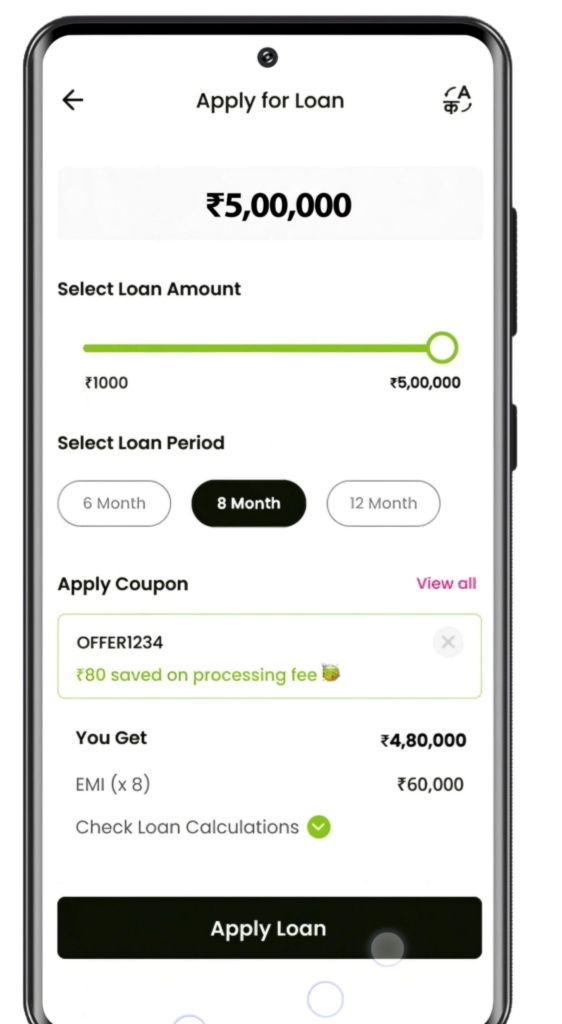

एक यूजर ने अपना अनुभव साझा करते हुए बताया कि उसे 5000 रुपये का लोन अप्रूव हुआ, लेकिन उसके अकाउंट में सिर्फ 2700 रुपये जमा हुए। इसके बाद, मात्र 7 दिनों में उसे 5200 रुपये चुकाने के लिए कहा गया। इसका मतलब है कि 2700 रुपये पर 7 दिनों में लगभग 92% का ब्याज वसूला जा रहा है, जो कि किसी भी वैध फाइनेंशियल इंस्टीट्यूशन के मानकों से कहीं ज्यादा है। यह साफ संकेत है कि Creditrack Credit Assistant पारदर्शी लोन सर्विस देने के बजाय लोगों को लूटने का जरिया बन रही है।

क्या यह RBI रजिस्टर्ड NBFC के साथ काम करती है?

भारत में कोई भी वैध लोन ऐप जो लोन प्रोवाइड करती है, उसे रिजर्व बैंक ऑफ इंडिया (RBI) के दिशा-निर्देशों का पालन करना होता है और किसी रजिस्टर्ड नॉन-बैंकिंग फाइनेंशियल कंपनी (NBFC) के साथ पार्टनरशिप में काम करना जरूरी होता है। लेकिन Creditrack Credit Assistant के बारे में कोई ठोस जानकारी उपलब्ध नहीं है जो यह साबित करे कि यह RBI से मान्यता प्राप्त NBFC के साथ जुड़ी है। बिना रजिस्ट्रेशन के काम करने वाली ऐसी ऐप्स अक्सर फर्जी होती हैं और यूजर्स को ठगने के लिए डिज़ाइन की जाती हैं।

कैसे पहचानें कि यह फ्रॉड ऐप है?

Creditrack Credit Assistant जैसी ऐप्स से बचने के लिए कुछ लाल झंडों (Red Flags) पर ध्यान देना जरूरी है:

- हाई इंटरेस्ट रेट्स और छिपे हुए चार्जेस: वैध लोन ऐप्स पारदर्शी तरीके से ब्याज दरें और फीस बताती हैं। लेकिन इस ऐप में लोन की राशि का बड़ा हिस्सा काट लिया जाता है और फिर भारी ब्याज वसूला जाता है।

- शॉर्ट-टर्म लोन की मजबूरी: 7 दिनों जैसे बेहद कम समय में पूरा भुगतान करने का दबाव यूजर्स को कर्ज के चक्र में फंसाता है।

- RBI रजिस्ट्रेशन की कमी: अगर कोई ऐप अपने NBFC पार्टनर या RBI रजिस्ट्रेशन की जानकारी साफ तौर पर नहीं देती, तो यह संदिग्ध है।

- अनचाही परमिशन: कई फर्जी ऐप्स आपके फोन के कॉन्टैक्ट्स, गैलरी और डेटा तक पहुंच मांगती हैं, जिसका इस्तेमाल बाद में ब्लैकमेलिंग के लिए हो सकता है।

- पॉजिटिव रिव्यूज पर शक: प्ले स्टोर पर ढेर सारे 5-स्टार रिव्यूज फर्जी हो सकते हैं, जो यूजर्स को भ्रमित करने के लिए डाले जाते हैं।

फर्जी लोन ऐप्स से होने वाले नुकसान

Creditrack Credit Assistant जैसी अनरजिस्टर्ड ऐप्स से लोन लेना आपके लिए कई जोखिम पैदा कर सकता है:

- फाइनेंशियल लॉस: ऊंची ब्याज दरों और छिपे चार्जेस की वजह से आप जरूरत से ज्यादा पैसे चुकाते हैं।

- डेटा चोरी: आपकी पर्सनल जानकारी जैसे आधार, पैन और बैंक डिटेल्स का गलत इस्तेमाल हो सकता है।

- हरासमेंट: रिपेमेंट न करने पर ये ऐप्स यूजर्स को धमकियां देती हैं और उनके कॉन्टैक्ट्स को परेशान करती हैं।

- क्रेडिट स्कोर पर असर: अगर आप समय पर पेमेंट नहीं कर पाते, तो यह आपके क्रेडिट स्कोर को नुकसान पहुंचा सकता है।

क्या करें अगर आप फंस गए हैं?

अगर आपने गलती से Creditrack Credit Assistant Loan App से लोन ले लिया है या ऐसी किसी फर्जी ऐप से परेशान हैं, तो ये कदम उठाएं:

- शिकायत दर्ज करें: नेशनल साइबर क्राइम रिपोर्टिंग पोर्टल (cybercrime.gov.in) पर अपनी शिकायत दर्ज करें।

- RBI से संपर्क करें: RBI के सachet पोर्टल पर ऐसी ऐप्स की रिपोर्ट करें।

- बैंक को सूचित करें: अपने बैंक को तुरंत बताएं और संदिग्ध ट्रांजैक्शंस को ब्लॉक करने के लिए कहें।

- कानूनी सलाह लें: किसी वकील से सलाह लेकर अपने अधिकारों की रक्षा करें।

सुरक्षित लोन ऐप्स कैसे चुनें?

- हमेशा RBI से रजिस्टर्ड NBFC के साथ काम करने वाली ऐप्स चुनें, जैसे KreditBee, MoneyView या Fibe।

- लोन लेने से पहले ऐप की टर्म्स एंड कंडीशंस, ब्याज दरें और रिव्यूज चेक करें।

- ऐसी ऐप्स से बचें जो बहुत आसान और तुरंत लोन देने का वादा करती हैं बिना किसी डॉक्यूमेंटेशन के।

निष्कर्ष: सावधानी ही बचाव है

Creditrack Credit Assistant भले ही क्रेडिट स्कोर बढ़ाने का दावा करे, लेकिन इसके पीछे की सच्चाई इसे एक संभावित फ्रॉड ऐप बनाती है। हाई इंटरेस्ट रेट्स, छिपे चार्जेस और RBI रजिस्ट्रेशन की कमी इसे संदिग्ध बनाते हैं। अगर आपको तुरंत पैसों की जरूरत है, तो हमेशा भरोसेमंद और रेगुलेटेड लोन ऐप्स का इस्तेमाल करें। अपनी मेहनत की कमाई और पर्सनल डेटा को सुरक्षित रखने के लिए सावधानी बरतें और ऐसे जाल में न फंसें।