Urgent ₹80,000 Cash Loan App: A Comprehensive Guide

In today’s fast-paced world, financial emergencies can arise at any moment. Be it medical expenses, home repairs, or an unexpected bill, the need for instant cash can catch anyone off guard. In India, digital technology has made addressing such crises easier, particularly through instant loan-providing mobile apps. These apps claim to offer loans up to ₹80,000 in just minutes, without complex paperwork or the need to visit a bank branch. In this article, we will delve into the features, processes, benefits, and potential risks of a leading Indian loan app, which we will not name but is widely used across India for quick personal and business loans.

What is an Instant Loan App?

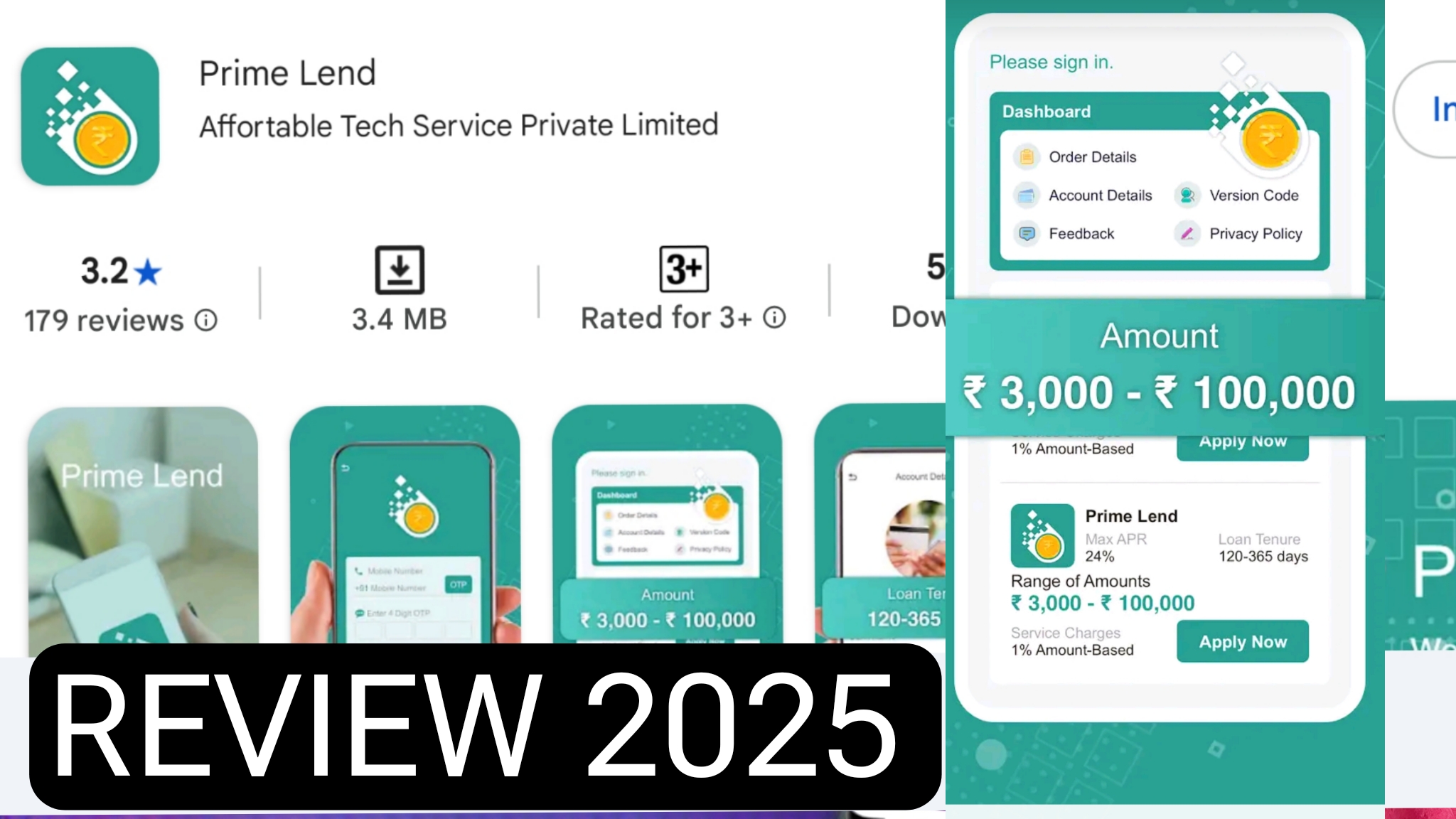

Instant loan apps are digital platforms that allow users to secure loans through their smartphones in a matter of minutes. These apps offer minimal documentation, swift approval, and direct fund transfers to bank accounts. Specifically, this app specializes in providing personal loans, business loans, and other financial solutions, making it a popular choice for those needing an urgent ₹80,000. The app offers loans up to ₹5 lakh, with flexible interest rates and repayment tenures.

Key Features of This App

- Instant Loan Approval and Disbursal:

This app is renowned for its rapid approval process. Users can apply for a loan in just 5 minutes, and upon approval, funds are credited to their bank account within hours. Securing an ₹80,000 loan is straightforward, provided the user meets the eligibility criteria. - Minimal Documentation:

Unlike traditional banks, which require extensive paperwork and lengthy processes, this app operates with basic documents like an Aadhaar card, PAN card, and bank statements. In some cases, a selfie and KYC documents suffice. - Flexible Repayment Tenure:

Users can choose repayment tenures ranging from 3 months to 60 months. For an ₹80,000 loan, monthly EMIs can be adjusted based on the user’s income and convenience. For instance, with a 33% annual interest rate over an 18-month tenure, the monthly EMI would be approximately ₹5,700, including processing fees and GST. - No Collateral Required:

The app provides unsecured personal loans, meaning users do not need to pledge assets or provide a guarantor. This feature makes it appealing for those seeking instant cash without collateral. - RBI Compliance:

The app adheres to the guidelines of the Reserve Bank of India (RBI) and the Ministry of Electronics and Information Technology (MeitY). This ensures transparent collection practices, with no threats or abusive behavior toward users. All calls are recorded, and payments are collected solely through the app or website. - Privacy and Data Security:

The app prioritizes user privacy. It does not access your contact list or reach out to friends or relatives for loan repayment. Data is transferred securely via HTTPS connections.

Process to Obtain an ₹80,000 Loan

Securing an ₹80,000 instant loan through this app is a simple and fully digital process. The steps are outlined below:

- App Download and Registration:

Start by downloading the app from the Google Play Store or Apple App Store. For registration, enter your mobile number and basic details. Complete the verification process using an OTP. - KYC and Document Upload:

Upload your Aadhaar card, PAN card, and recent bank statements. In some cases, you may need to upload a selfie. This process is entirely online and takes just a few minutes. - Select Loan Amount and Tenure:

The app will suggest a loan amount based on your eligibility. Choose ₹80,000 and select a repayment tenure (e.g., 12, 18, or 24 months) that suits your convenience. - Approval and Disbursal:

After submitting the application, the app evaluates your credit profile and documents. Approval can be granted within minutes, with funds credited to your bank account within 24 hours. - Auto-Debit Setup:

To streamline repayments, set up auto-debit from your bank account. This ensures your monthly EMI is deducted on time.

Benefits of This App

- Speed and Convenience: For an urgent ₹80,000 requirement, this app is one of the fastest solutions. The entire process is online, saving time and effort.

- Flexibility: Users can choose loan amounts and repayment tenures based on their financial capacity.

- Transparency: Interest rates, processing fees, and total repayment amounts are clearly stated, with no hidden charges.

- Versatile Usage: The loan can be used for various purposes, such as medical emergencies, weddings, education, travel, or business expansion.

Potential Risks and Precautions

While this app offers numerous benefits, there are risks that users should be aware of:

- High Interest Rates:

The app’s interest rates range from 18% to 33% per annum, with the APR (Annual Percentage Rate) potentially reaching 32% to 63%. For example, an ₹80,000 loan at a 33% interest rate over 18 months may result in a total repayment of approximately ₹1,02,000. Users must ensure they can afford the EMIs. - Technical Issues:

Some users have reported issues such as approved loan amounts not being credited or problems with auto-debit setup. In such cases, contact customer support immediately. - Late Payment Penalties:

Missing EMI payments can lead to late fees and a negative impact on your credit score. - Borrow Responsibly:

Only borrow what you can comfortably repay. Overborrowing can lead to financial stress.

Customer Experience

Based on user reviews, this app is praised for its ease of use, quick approvals, and flexible repayment options. Many users have described it as a reliable solution for emergency financial needs. For instance, one user shared that they needed urgent funds for their mother’s medical treatment, and the app provided the money within hours. However, some users have complained about technical glitches and high interest rates.

Conclusion

For an urgent ₹80,000 cash loan, this app offers a convenient and swift solution. With minimal documentation, quick approvals, and flexible repayment options, it is ideal for those facing financial emergencies. However, due to high interest rates and potential technical issues, users must exercise caution and borrow only what they can repay. Before using this app, assess your financial situation and carefully review the terms and conditions. If you’re seeking instant cash, this app is certainly worth considering, provided you fully understand its terms.