KPAISA : Investments & Loans App Review 2024

Experience the future of finance with KPAISA – the one stop solution for all your financial needs diversify your investments with digital gold, mutual funds, FMPP, and liquid funds take control of your finances with flexible loans effortless bill payments and more.

Key Features :

- Diversify investments : beat inflation with carefully curated investment products

- Rewards : get rewarded every time you invest with kpaisa

- Bill Payments : pay bills and recharge with exclusive rewards and offers

- Air Travel : explore with best discounts and cheap rates

- Spend analysis : track your expenses and take charge of your money

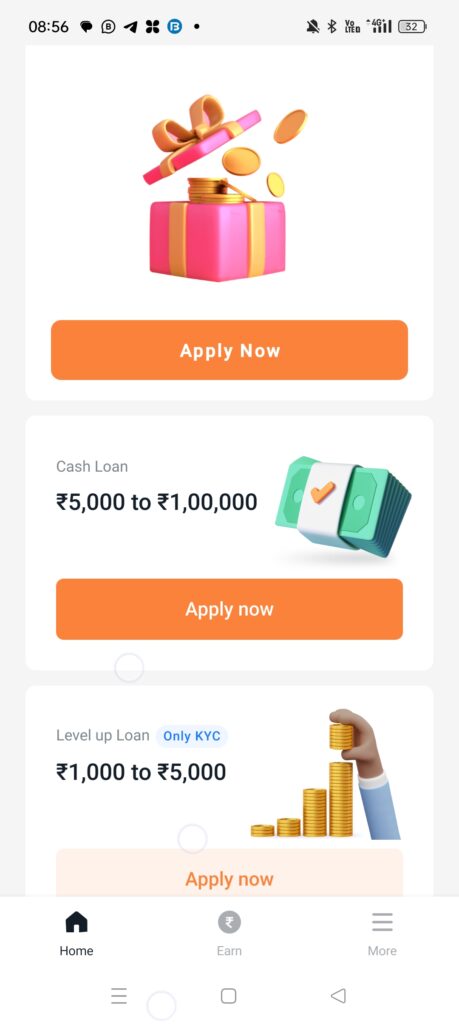

Get Instant Personal Loans

- Loan amount starting from 5K to 5 Lac

- Repay loan within 3 – 36 months

- Interest rate : starting 2% per month

- Annual percentage Rate : ranges between 16.75% to maximum 74%

- Loan processing fee : up to 3% of the loan amount

Note : personal loans are only available to Indian citizens within the territory of India

Lending Partners (NBFC) :

- Early salary services private limited ( formerly known as Ashish securities private limited) https//www.fibe.in/our securing – Partner/

- BHANIX finance and finance and investment limited (CASHe) : https//www. CASHe.co.in/our partners/

Example :

- Loan amount : 50,000

- processing fee (2% of loan amount 18% GST) : 1,180

- Total loan amount : 51,180

- Interest : 24% p.a. (on reducing principal balance interest calculation )

- Tenure : 12 months

- Your EMI : 4,840

- Total amount to be paid : 4,840 x 12 = 58,075

- Total interest paid : 58,075 – 51,180 = 6,895

- Total cost of loan : 6,895 + 1,180 = 8,075

- APR : 28.58%

Coming soon : more financial services we value your feedback – tell us what you want

Join thousands of satisfied users and download KPAISA now to experience seamless finance your financial freedom begins here

Get the loan gold fast loan or investment ticket credited in your account in just a single click I have been using this app and found it really nice and the user interface is also very good it has completely transformed how I manage my finances I must say that everyone download this app