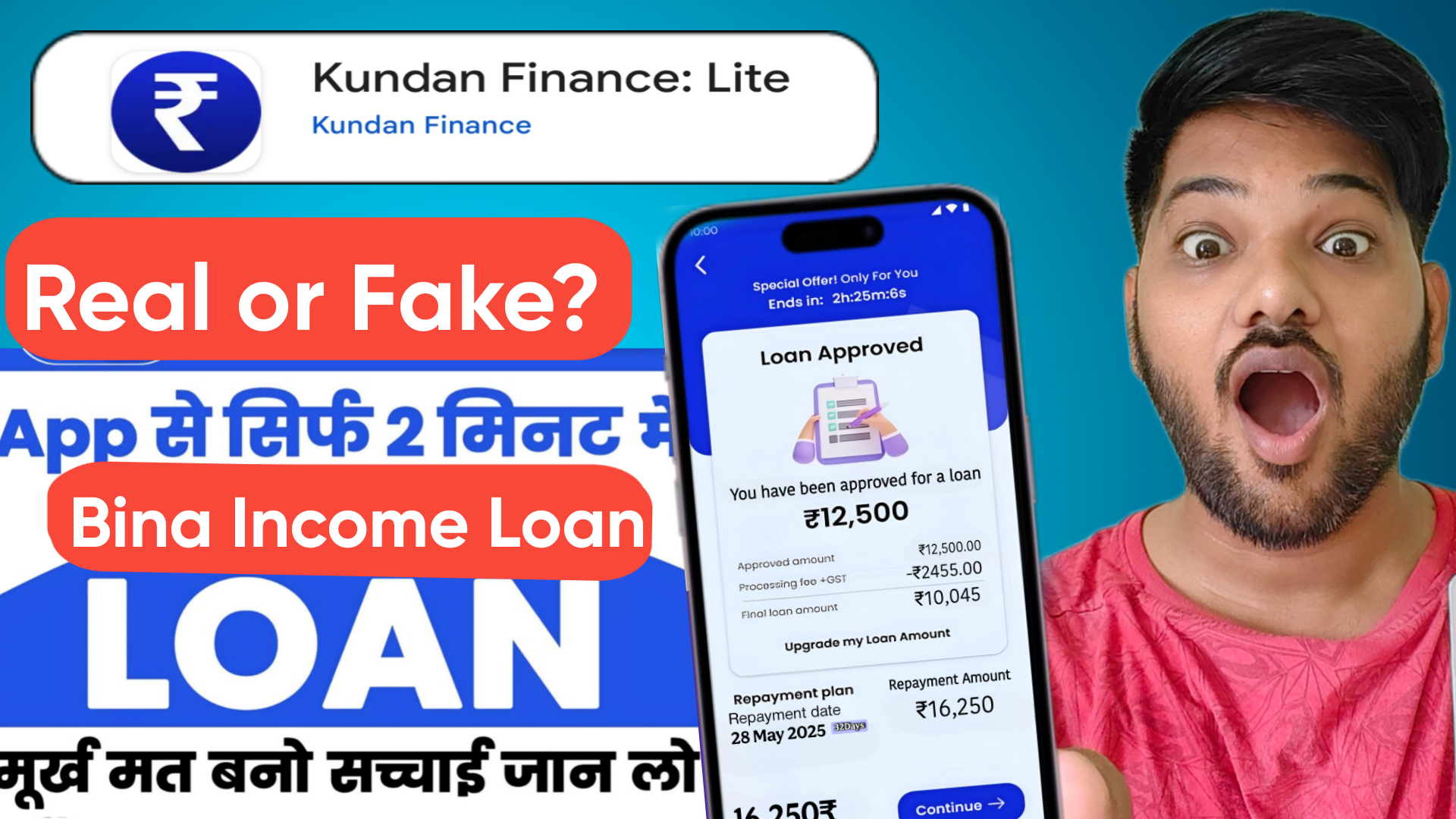

Kundan Finance: Lite Loan App Review 2025 – A Quick and Easy Borrowing Solution?

In today’s fast-paced world, getting quick access to funds without jumping through endless hoops is a game-changer. Enter Kundan Finance: Lite, an RBI-registered NBFC-powered loan app promising instant personal loans up to ₹2 lakhs with minimal hassle. But does it live up to the hype? In this 2025 review, we’ll dive into what makes Kundan Finance: Lite stand out, its pros and cons, and whether it’s the right choice for your financial needs.

What is Kundan Finance: Lite?

Kundan Finance: Lite, powered by Ram Fincorp, is a digital loan facilitation platform designed to simplify borrowing. With a fully online process, it aims to eliminate the need for physical interactions, long queues, or excessive paperwork. Whether you need funds for an emergency, a big purchase, or to tide you over, Kundan Finance offers personal loans ranging from ₹5,000 to ₹2,00,000, with loan tenures between 90 days and one year.

The app’s mission is clear: to provide a seamless, affordable, and quick borrowing experience. With features like instant approvals, low-interest rates (up to 35% per annum), and flexible repayment options, it’s marketed as a user-friendly solution for salaried individuals aged 21 to 55.

How Does It Work?

Applying for a loan through Kundan Finance: Lite is straightforward. You download the app, submit your details, and upload minimal documentation (PAN card, Aadhaar card, salary slips, and bank statements). Once approved, the loan amount—minus processing fees and GST—is credited to your bank account within 30 minutes. The app boasts a transparent process with no hidden charges, which is a big plus for anyone wary of fine print.

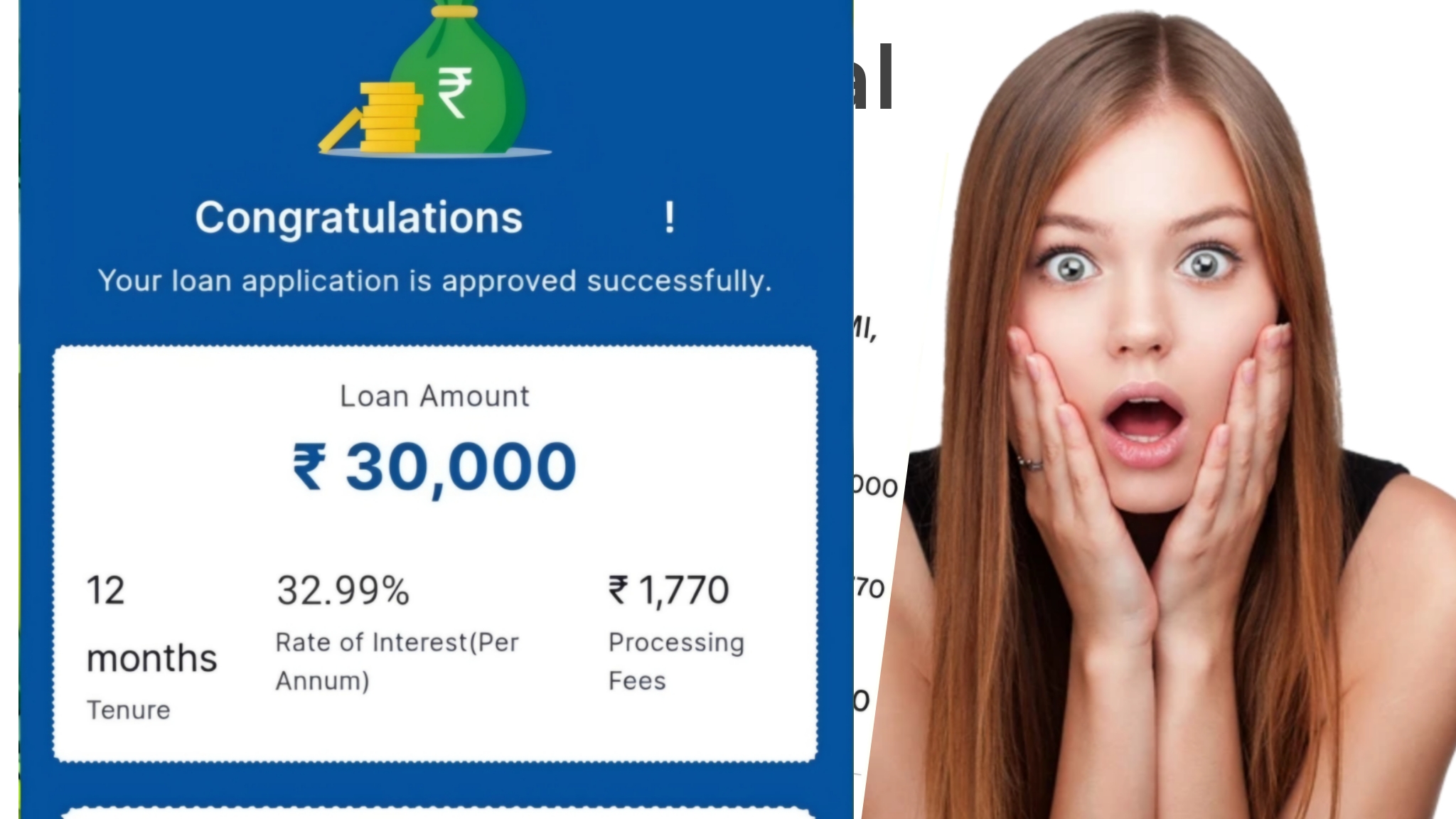

To give you a clearer picture, here’s a sample loan breakdown provided by the app:

- Loan Amount: ₹30,000

- Interest Rate: 30% per annum

- Loan Tenure: 3 months

- Total Interest: ₹2,250

- Processing Fee + GST: ₹590

- In-Hand Amount: ₹29,410

- Total Repayable Amount: ₹32,250

- Monthly EMI: ₹10,750

Note: Actual figures may vary based on your eligibility and loan terms.

The app also charges late payment fees and pre-closure charges where applicable, so it’s worth reviewing the terms carefully before signing up.

Key Features and Advantages

Kundan Finance: Lite brings a lot to the table, especially for those seeking quick and convenient loans. Here’s what stands out:

- Customized Loan Solutions: Loans are tailored to your needs, whether you need a small amount for a short-term expense or a larger sum for bigger plans.

- Instant Approval and Disbursal: The promise of funds in your account within 30 minutes is a major draw for emergencies.

- Low Documentation: You only need a PAN card, Aadhaar card, recent salary slips, and bank statements, making the process hassle-free.

- Transparent Process: No hidden fees, and the terms are clearly laid out upfront.

- Flexible Repayment Options: With tenures ranging from 90 days to a year, you can choose a repayment plan that suits your budget.

- Secure Data System: The app uses advanced encryption to protect your personal and financial information, addressing privacy concerns.

Eligibility and Documentation

To qualify for a loan, you need to meet the following criteria:

- Age: 21 to 55 years

- Income: Minimum monthly income of ₹15,000

- Residency: Indian citizen or resident

- Documents: PAN card, Aadhaar card, 3 months’ salary slips, 3-6 months’ bank statements, and address proof

The minimal documentation makes it accessible for salaried individuals, though self-employed users might need to check with customer support for specific eligibility.

What’s Good About Kundan Finance: Lite?

After exploring the app’s features, here’s what makes it a compelling option in 2025:

- Speedy Process: The 30-minute disbursal claim is a lifesaver for urgent financial needs.

- User-Friendly Interface: The fully digital process means you can apply anytime, anywhere, without visiting a bank.

- Affordable Rates: While the interest rate (up to 35% p.a.) isn’t the lowest in the market, it’s competitive for an instant loan platform.

- Transparency: Clear breakdowns of fees, interest, and repayment amounts help you make informed decisions.

- RBI-Registered: Being backed by an RBI-registered NBFC (R.K. Bansal Finance Private Limited) adds a layer of trust.

What Could Be Better?

No app is perfect, and Kundan Finance: Lite has a few areas that might give you pause:

- High Interest Rates for Some: The maximum APR of 35% can feel steep, especially for larger loans or longer tenures.

- Processing Fees: Up to 5% of the loan amount (plus GST) is deducted upfront, reducing the actual amount you receive.

- Limited Loan Amount: The ₹2 lakh cap might not suffice for bigger financial needs.

- Late Payment Fees: While not detailed in the description, late payment fees could add up if you miss an EMI.

- Age Restriction: The 21-55 age limit excludes older borrowers who might still need loans.

Security and Privacy

Kundan Finance: Lite takes data security seriously, using advanced encryption to protect your information. Their privacy policy (available at kundanfinance.com/privacypolicy) outlines how your data is handled, which is reassuring for anyone concerned about online financial transactions.

How Does It Compare?

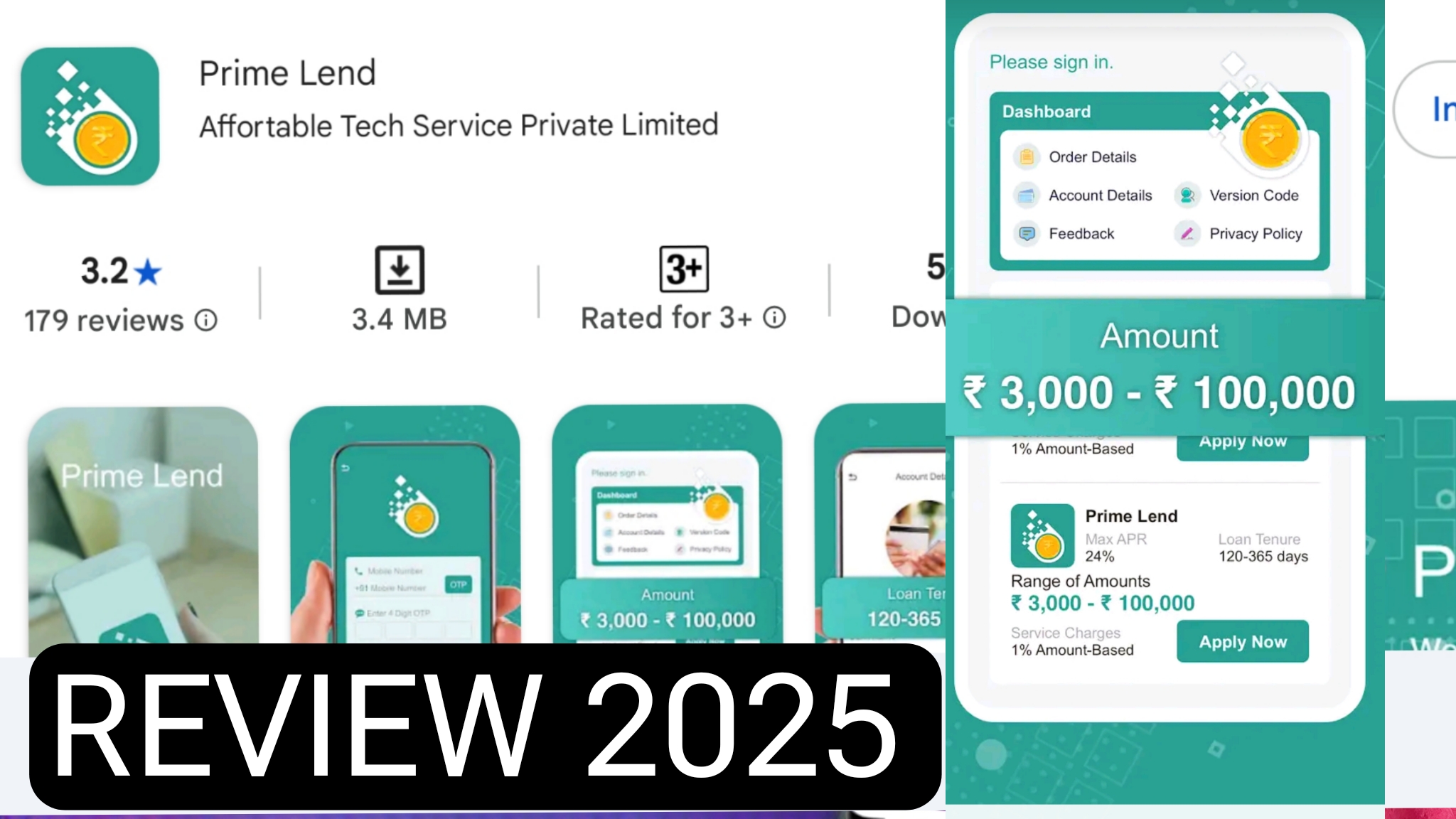

Compared to other loan apps in 2025, Kundan Finance: Lite holds its own with its quick disbursal and minimal documentation. Apps like MoneyTap or PaySense offer similar instant loans, but Kundan’s RBI registration and transparent fee structure give it an edge for trust-conscious users. However, if you’re looking for lower interest rates, traditional banks or credit unions might be worth exploring, though they often involve slower processes.

Who Should Use Kundan Finance: Lite?

This app is ideal for:

- Salaried individuals needing quick funds for emergencies or short-term expenses.

- Tech-savvy borrowers who prefer a fully digital loan process.

- Those with a steady income of ₹15,000+ and basic documentation.

If you’re looking for large loans or have irregular income, you might need to explore other options.

Final Verdict

Kundan Finance: Lite delivers on its promise of a fast, transparent, and user-friendly borrowing experience. Its quick disbursal, minimal paperwork, and RBI-backed credibility make it a solid choice for instant personal loans in 2025. However, the relatively high interest rates and processing fees mean you should weigh your options, especially for larger loans.

If you need cash in a pinch and value convenience, Kundan Finance: Lite is worth a try. Just make sure to read the terms and conditions (available at kundanfinance.com/conditions) and plan your repayments carefully to avoid extra charges.

For more details or to apply, visit their website at kundanfinance.com or reach out to their team at +91 9899985495 or info@kundanfinance.com. Have you used Kundan Finance: Lite? Let us know your experience in the comments below!

Disclaimer: Always review loan terms and ensure timely repayments to avoid additional fees. Borrow responsibly!