2 New Personal Loan App Without Cibil Score Loan App Review 2024

Hello dosto aaj ke is post me ham do aisi new loan company ke bare me apko bataenge jisme loan lene ke liye apko koi bhi income proof aur cibil score ki jarurat nhi hai aap bahut hi aasani se in application se personal loan prapt kar sakte hai vah bhi 1000 se lekar ke pure ke pure 5 lakh rupay Tak keval aapke aadhar card aur Pan Card me to pura post achhe se padhe aur hamne kuchh tarike bataye hai jaha se aap in application me loan apply karege aur post ke neeche hamne in application ke link bhi rakhe hai jaha se aap directly loan apply bhi kar sakte hai.

Table of Contents

Required Documents

- Aadhar card for address verification

- Pan card for cibil score

- Applicants age must be more than 21 years

- Active bank account

- No loan default in last 3 months

Eligibility Criteria

- Indian resident

- Salaried employee / business owners / self employed

- Above 21 years of age

- Savings bank account holder

- Decent cibil score

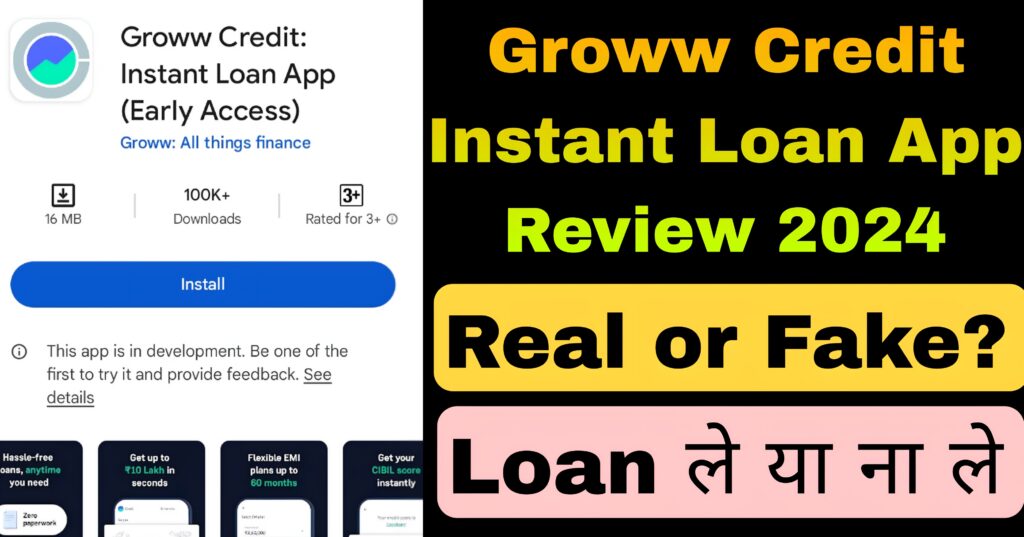

Groww Credited : Instant Loan App

Whether you an instant personal loan for an unexpected expenses or looking for easy EMI options to finance your next big purchase, or simply want to check CIBIL score for free Groww Credit is your all in one credit app

Instant personal loan

Groww credit offers instant personal loans up to 12.5 lakh with flexible repayments options at competitive interest rates whether you are salaried or self employed get instant approvals and funds disbursed directly to your bank account

Loan amount of your choice : choose your instant personal loan amount up to your pre approved limit (max 10 lakh)

Flexible tenure : loan repayment tenure ranging from 3 months to 60 months

Transparent terms : no hidden charges, only clear and upfront terms

Instant personal loan :

- Tenure : 3 to 60 months

- APR : 13 – 48%

Note : personal loans are available for select users

Registered NBFCs and banks (Lenders) on Groww Credit :

- Groww Creditserv technology Pvt Ltd

- Kisetsu Saison finance (India) Pvt Ltd

- IDFC first bank LTD

A representative example of the cost of a loan, including principal & all applicable fees:

- Tenure – 12 months

- Rate of interest – 15% per annum

- Processing fees – 1000 ( 2% inclusive GST)

- Total interest – 4156

- EMI – 4513

- APR – 18.89%

- Amount disbursed – 49000

- Total repayment amount – 54156

Privacy policy : https//groww.in /privacy-policy

Groww’s registered office : Vaishnavi tech park, south tower, 3rd and 4th floor, sarjapur main road, Bengaluru, Karnataka – 560103

Yuva – Personal Loan App Review 2024

Yuva is an instant personal loan app provided by RBI registered NBFC – YUVARAJ FINANCE PRIVATE LIMITED Our goal is to convey a sence of youthful energy, dynamism, and forward thinking

- details and representative cost calculation :

- Loan amount : up to 20,000 rs

- Repayment period : 61 – 365 days

- Interest rate : 36% per annum

- Fees : start at 99 rs

- Maximum annual percentage Rate : 97%

2. Data Protection :

- We comply with regulation rules and industry standards being the member of face

- Your data is encrypted securely stored and can be requested to delete

- we don’t transfer data to third parties

- Yuva app does not ask for sensitive permission

- For more details please visit data safety section

3. Main features of yuva instant loan app :

- easy to get user interface and modern design

- optimized process with minimum steps and information required

- various loan repayment options (UPI, card, wallet)

- 24/7 customer support (email, helpline, whatsapp chat)

5. Yuva loan app provides

- No hidden or upfront fees

- Only necessary documentation

- Fast decision

- New to credit customers can be also considered

- Higher loan amounts for repeat clients

6. How it works

- Register with phone number

- pick affordable loan amount and term

- provide data for loan application and verify KYC

- Recieve decision and sign loan agreement in case of positive one

- Right away get money in your bank account

7. Any questions

Please check app support section