LendingTree Personal loans Reviews:Good or Bad ?

LendingTree Personal loans Reviews: Do You Need Some emergency Funding for Repayment of dues or Settlements of Bills then You are probably looking for best sites for personal loans.Then don’t worry we have got you Covered with our Top loan app reviews plateform

Table of Contents

On this Personal loan Review You Will Find the Following Answers

- What is Lending tree personal loans and How Can You Apply on this loan ?

- Terms and conditions of getting personal loans via lending tree ?

- LendingTree Personal loans Reviews from Clients

- The Pros and cons of LendingTree Personal loans

- Charges of LendingTree Personal loan ?

- Privacy and security of LendingTree Personal loan

- Frequently asked questions about LendingTree loan

What is LendingTree Personal loans & Why is it Best ?

LendingTree is the lending plateform which allows user to access personal loans offer for their needs.it is the plateform between user of USA and Extensive Network of Money Lender So We Can Say That LendingTree is the Service Provider Not a Lender

Know About : Top 5 Personal loans in USA

Here are the financial products of LendingTree

- Home mortgage loan

- Home Equity loans

- Auto loans

- Business loans

- Credit card

- Personal loans

- Reverse Mortgage loans

How to apply personal loans in LendingTree

To Borrow Money from LendingTree Personal loans Follow these Steps which is helpful for understanding of Complete Process of Applying loans

- First Visit the LendingTree official Website

- Fill out free loan application in their Website in order to get lender for you

- First step :- Choosing the loan type which You want to take example we select Personal loans

- After that You need to select Loan Purpose of this Personal loans Example :- Debt Consolidation , Debt Payoffs ,Home improvement ,Home Buying ,Credit Card Settlements

- Others loans purpose like Weding Expenses , Medical Expenses

Select loan amounts and Apply

- Now You will need to choose loan amounts

- The Maximum loan amount you can take from LendingTree Personal loan is 50,000$ Which Huge For Simple Purpose

- Minimum loan amount you can take from this Personal loan is 1000$

Fill Some additional Information for LendingTree Personal loans

- What is Your Zip code for address locations ?

- What is your Street Address ?

- Type of Residence ( Rent or Own)?

- Estimate Your Credit score : 1.Excellent ( 720 or better ) 2.Good (680-719) 3.Fair (649-679) 4.Poor under 640

- Where were you born?

- What’s Your Employment Status?

- What’s Your yearly Pre tax income?

- Fill Your Phone number and additional details

LendingTree Personal loans Terms and Eligibility

- Your age must be 18 or older

- You must have a Valid Social Security Number

- Have A steady Stream of Income

- You should have Responsible Credit score

- Good Debt to income Ratio ( Less than 36%)

- The loan will need to be Repaid within 3 to 7 year

What Credit Score do you need to get Personal loans from LendingTree?

While a minimum credit score isn’t mentioned in the Requirements Qualifications to apply those who have a good Credit score Higher Chance of getting a personal loans from LendingTree,in Addition to this it is Recommended You have Credit Score At least 585+

Pros and Cons of LendingTree Personal loans

- Pros :- Free Service

- Larger Lender networks

- Comparing offer doesn’t affect Your Credit score

- Cons:- You Might not qualify for advertiser’s Rates because interest Rates vary on Customer Credit score

- Could Receive Lenders ads after Singing Up

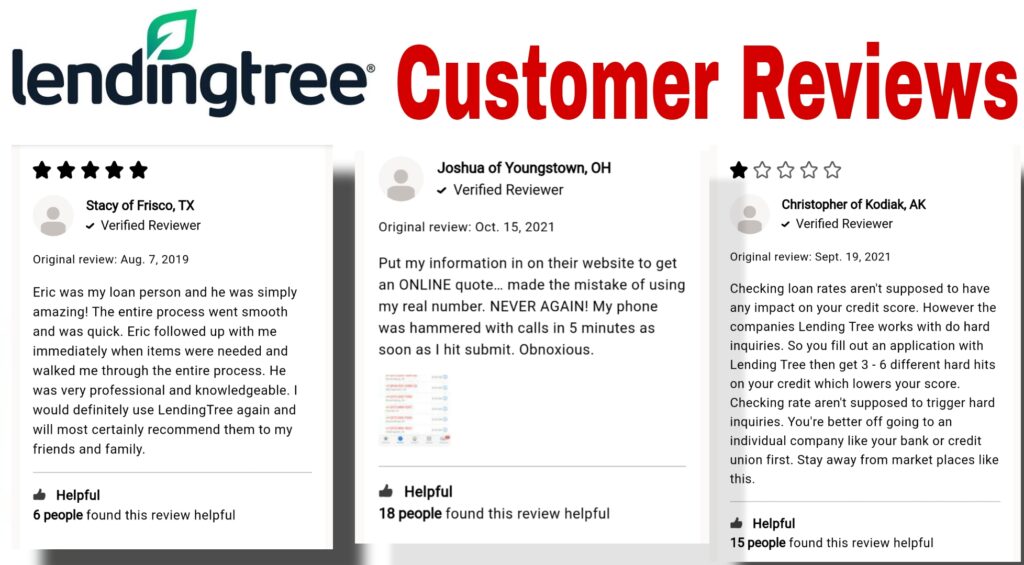

LendingTree Personal loans : Customers Reviews