Instant Mudra Loan App Review 2025: Is It Real or Fake Loan

In today’s fast-paced world, financial emergencies can arise unexpectedly, and having quick access to funds is crucial. Instant Mudra Loan App has emerged as a popular solution for salaried individuals in India seeking instant personal loans. With a rating of 3.9 stars and over 5 lakh downloads on the Google Play Store, Instant Mudra promises a seamless, 100% digital loan application process, quick approvals, and disbursements within hours. But is it as reliable and user-friendly as it claims? In this comprehensive Instant Mudra Loan App review, we’ll dive into its features, eligibility criteria, loan terms, customer feedback, and potential drawbacks to help you decide if it’s the right choice for your financial needs.

What is Instant Mudra Loan App?

Instant Mudra, operated by Chintamani Finlease Limited, is a mobile-based financial technology platform that offers instant personal loans in India. The app targets salaried individuals facing short-term financial crunches, providing loans ranging from ₹3,000 to ₹30,000. With a motto of “Our Principle is in Building Good Relationships,” Instant Mudra aims to simplify the borrowing process by eliminating tedious paperwork and long bank queues.

The app is designed to cater to the urgent financial needs of young professionals and salaried individuals, offering a 100% online process, quick approvals, and direct bank transfers. Instant Mudra operates as a Non-Banking Financial Company (NBFC) and collaborates with lending partners to disburse loans. Its user-friendly interface and promise of hassle-free borrowing have made it a go-to choice for many, but customer reviews reveal a mixed experience.

Key Features of Instant Mudra Loan App

Instant Mudra stands out for its streamlined approach to personal loans. Here are the key features that make it appealing:

- High Loan Amount: Borrow between ₹3,000 and ₹30,000, ideal for small, urgent expenses like medical bills, travel, or monthly cash shortages.

- 100% Online Process: The entire loan application process is digital, from registration to document submission and approval.

- Quick Approvals: Loans are approved within 5-48 hours, ensuring funds are available when you need them most.

- Collateral-Free Loans: No need to pledge assets or provide security, making it accessible to a wide range of borrowers.

- Flexible Tenure: Loan repayment terms range from 3 months to 24 months, allowing borrowers to choose a plan that suits their financial situation.

- Low Documentation: Minimal paperwork, requiring only basic documents like a selfie, Aadhaar/PAN card, salary slips, and bank statements.

- Credit Score-Based Lending: Loans are granted based on a comprehensive credit score, making it accessible even for those with lower CIBIL scores.

- No Hidden Charges: Transparent fee structure with a one-time processing fee (up to 5% of the loan amount plus GST) and a maximum APR of 23%.

These features position Instant Mudra as a convenient option for those seeking instant personal loans online in India. However, the app’s performance and customer satisfaction vary, as we’ll explore later.

Eligibility Criteria for Instant Mudra Loan

To qualify for a loan through Instant Mudra, applicants must meet the following criteria:

- Citizenship: Must be an Indian citizen.

- Age: 21 years or older.

- Income: Minimum monthly salary of ₹25,000.

- Bank Account: One active bank account.

- Contact: A working phone number.

These requirements are straightforward, making the app accessible to a large segment of salaried professionals. However, the app currently serves only salaried individuals, with plans to expand to other categories in the future.

Documents Required for Instant Mudra Loan

The documentation process is minimal, aligning with the app’s promise of a hassle-free experience. You’ll need:

- Photograph: A selfie.

- Income Proof: Last 3 months’ salary slips.

- Bank Statement: Updated 6 months’ bank statements of your salary account.

- Employment Proof: Employee ID card and visiting card.

- Identity Proof: Aadhaar card or PAN card.

- Signature Proof: Banker verification after loan approval.

This minimal documentation ensures that applicants can quickly submit their details and move forward with the loan process.

How Does Instant Mudra Loan App Work?

Applying for a loan through Instant Mudra is simple and can be completed in a few steps:

- Download the App: Install the Instant Mudra Personal Loan App from the Google Play Store.

- Register: Sign up using your mobile number and verify with an OTP.

- Enter Details: Fill in personal and financial details to check your eligibility.

- Choose Loan Amount: Select a loan amount between ₹3,000 and ₹30,000.

- Upload Documents: Submit the required documents digitally.

- Loan Approval: Once approved (within 5-48 hours), the loan amount is credited directly to your bank account.

The app’s user-friendly interface and quick processing make it an attractive option for those needing instant loans in India.

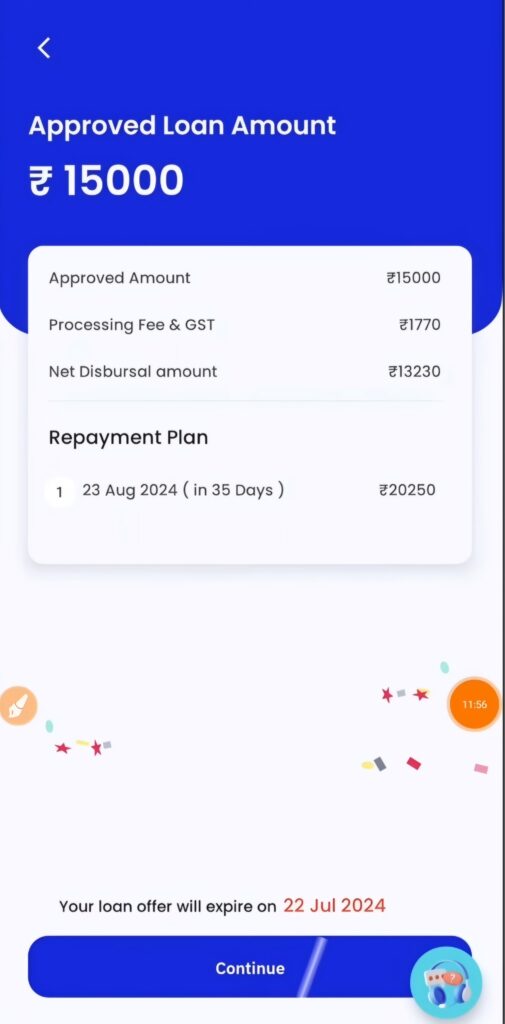

Loan Amount, Tenure, Fees, and Charges

Here’s a breakdown of the financial aspects of borrowing from Instant Mudra:

- Loan Amount: ₹3,000 to ₹30,000.

- Loan Tenure:

- Minimum: 3 months.

- Maximum: 24 months (including renewal time).

- Interest Rate: Maximum APR of 23%.

- Processing Fee: Up to 5% of the loan amount (exclusive of GST).

- Hidden Charges: None, as per the app’s claims.

Example Calculation:

If you borrow ₹30,000 at an interest rate of 23% per annum with a processing fee of ₹750 for a 12-month tenure, you’ll repay a total of ₹36,900. This breaks down to a monthly EMI of ₹3,075.

This transparent fee structure is a positive aspect, but some users have reported dissatisfaction with the low loan amounts offered, as we’ll discuss in the customer reviews section.

Customer Reviews: What Are Users Saying?

Customer feedback provides valuable insights into the app’s performance. While Instant Mudra has a respectable 3.9-star rating and over 5 lakh downloads, reviews are mixed, with both positive and negative experiences.

Positive Reviews:

Some users praise the app for its quick disbursements and helpful customer support:

- One user mentioned, “Very helpful app. In urgency, got the approval within 1-2 hours and disbursed in account with minimal documents.”

- Another user noted, “I am very satisfied with Instant Mudra as it helped me improve my CIBIL score. Staff is polite and cooperative.”

These reviews highlight the app’s ability to deliver on its promise of quick loans and support for users with lower credit scores.

Negative Reviews:

However, several users have reported significant issues, including low loan amounts, poor customer service, and technical glitches:

- Reena Parmar (12/03/25): “I had a very bad experience. Rude staff. They asked me too many documents and the loan amount they offered was just 4k… Anuradha’s chats were so bad, she called me ‘sir’ every time and was rude when I asked to close my application.” (65 people found this helpful)

- Raj Venati (12/04/25): “Worst app, don’t waste your time. They took nearly 3 days and only approved ₹3,000. You’ll get frustrated with their late responses.”

- Pushpendar Kumar (18/03/25): “Very bad services. They asked for documents but stopped responding after I submitted them. Totally fake promises.”

- Anil Kumar Reddy (24/03/25): “Waste app. Good for ₹1,000-₹4,000, but for higher amounts, you need to repay for 4-5 years to qualify for ₹30,000.”

- Ketan Mandlik (15/04/25): “They signed documents on my behalf, and I still haven’t received my loan. No one is responding.”

- Deepak Singh (01/03/25): “Poor application. Loan payment done, but support team doesn’t update the status automatically.”

- Raja Tripathi (13/04/25): “Absurd app. It gets stuck after the welcome page.”

- Lucky Lucky (28/02/24): “After collecting all my data, the app got stuck, and it’s been 3 days with no response. Worst experience.”

These reviews highlight recurring issues such as low loan approvals, unresponsive customer support, technical glitches, and rude staff behavior. The app’s inability to approve higher loan amounts for new users is a common complaint, with some users feeling misled by the promise of up to ₹30,000.

Pros and Cons of Instant Mudra Loan App

Pros:

- Quick and Easy Process: 100% online application with minimal documentation.

- Fast Disbursements: Loans credited within 5-48 hours.

- Collateral-Free: No need for assets or security.

- Transparent Fees: No hidden charges, with a clear breakdown of interest and processing fees.

- Low CIBIL Funding: Suitable for users with lower credit scores.

Cons:

- Low Loan Amounts: Many users report being approved for only ₹3,000-₹4,000, far below the advertised ₹30,000.

- Poor Customer Support: Complaints about rude staff and unresponsive teams.

- Technical Issues: App glitches, such as getting stuck on the home page or failing to update loan status.

- Limited Eligibility: Only available to salaried individuals with a minimum income of ₹25,000.

- Mixed Reputation: Negative reviews raise concerns about reliability and professionalism.

Is Instant Mudra Loan App Safe and Legit?

Instant Mudra is operated by Chintamani Finlease Limited, a registered NBFC, which lends credibility to its operations. The app is available on the Google Play Store and has a significant user base, indicating a level of legitimacy. However, concerns arise from customer reviews and a 2022 article by Wisdom Ganga, which flagged Instant Mudra for unethical practices, such as:

- Approving loans without user consent.

- Harassing customers for repayments, including cyberbullying.

- Collecting excessive personal data (camera, contacts, SMS, etc.) through broad app permissions.

The article also noted that Instant Mudra lacks transparency about its ownership and NBFC partners, raising red flags about its operations. While the app is not necessarily a scam, these concerns suggest caution. Users should carefully review the app’s privacy policy and permissions before applying.

How Does Instant Mudra Compare to Other Loan Apps?

To provide a balanced perspective, let’s compare Instant Mudra with other popular loan apps in India, such as My Mudra, KreditBee, and MoneyView:

- Loan Amount: Instant Mudra offers ₹3,000-₹30,000, while My Mudra provides up to ₹50 lakh, and KreditBee and MoneyView offer up to ₹5 lakh.

- Interest Rates: Instant Mudra’s maximum APR is 23%, compared to My Mudra’s 9.99%-24%, KreditBee’s 15%-29%, and MoneyView’s 16%-39%.

- Eligibility: Instant Mudra requires a minimum salary of ₹25,000, which is higher than KreditBee (₹10,000) and MoneyView (₹13,500).

- Customer Support: My Mudra and MoneyView have better reputations for responsive support, while Instant Mudra struggles with complaints about rudeness and delays.

- Approval Time: All apps promise approvals within 24-48 hours, but Instant Mudra’s actual approval amounts are often lower than advertised.

For users needing higher loan amounts or better customer service, alternatives like My Mudra or KreditBee may be more suitable. However, for small, urgent loans, Instant Mudra remains a viable option despite its drawbacks.

Tips for Using Instant Mudra Loan App

If you decide to use Instant Mudra, here are some tips to ensure a smooth experience:

- Check Eligibility First: Verify that you meet the income and age criteria to avoid rejection.

- Read the Fine Print: Review the loan terms, interest rates, and processing fees before signing.

- Limit Permissions: Be cautious about granting excessive app permissions (e.g., access to contacts or SMS).

- Contact Support Early: If you face issues, reach out to info@instantmudra.com promptly.

- Repay on Time: Timely repayments can improve your CIBIL score and eligibility for higher loan amounts.

- Start Small: Given the low approval amounts for new users, apply for a smaller loan to build trust with the app.

Conclusion: Should You Use Instant Mudra Loan App?

The Instant Mudra Loan App offers a convenient solution for salaried individuals seeking instant personal loans in India. Its 100% online process, quick approvals, and collateral-free loans make it appealing for small, urgent financial needs. However, the app’s low loan approval amounts, technical glitches, and poor customer support are significant drawbacks that cannot be ignored. Negative reviews, such as those from Reena Parmar and Raj Venati, highlight issues with rude staff, unresponsive teams, and misleading promises about loan amounts.

For those needing loans below ₹5,000 with minimal documentation, Instant Mudra can be a quick fix, especially if you have a lower CIBIL score. However, if you require higher amounts or a more reliable experience, consider alternatives like My Mudra, KreditBee, or MoneyView. Always weigh the pros and cons, read user reviews, and proceed with caution when sharing personal data.

If you’ve used Instant Mudra, share your experience in the comments below! For more information or to apply, visit the Instant Mudra website or download the app from the Google Play Store.