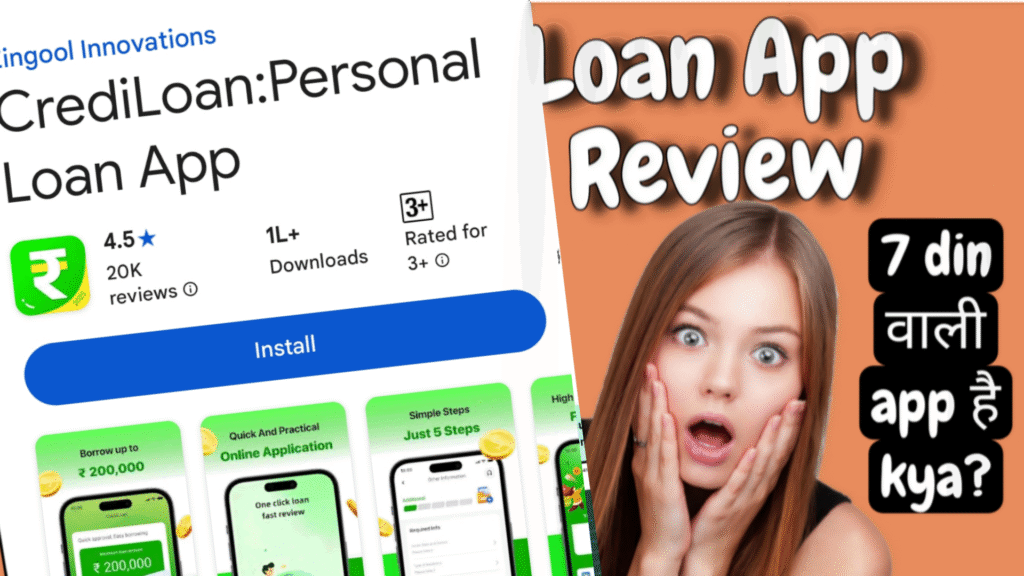

Loan112 Credit Loan App Scam Exposed: Heavy Charges, Harassment Aur Fake Promises Ki Pol Khul Gayi!

Loan112 App Kya Hai? Ek Quick Overview

Loan112 ek instant personal loan app hai jo Android ke liye available hai Google Play Store par. Yeh app claim karta hai ki aapko fast loan mil jayega without much paperwork, aur woh bhi minutes mein. App ka developer Devmuni Leasing & Finance Limited hai, jo ek finance company hai. Unke description ke according, yeh app hassle-free loans provide karta hai, low interest rates ke saath, aur good customer support. Download count bahut high hai (lakhs mein), aur rating 4.0 stars dikhta hai.

Lekin doston, yeh sab description par mat jaao! Play store ke descriptions companies khud likhti hain marketing ke liye. Asli picture toh users ke reviews se samajh mein aati hai, especially critical 1-star reviews se. Humne play store se (https://play.google.com/store/apps/details?id=com.fin.fintech.loanbaumen) aur provided screenshots se reviews collect kiye hain, aur yeh bata rahe hain ki yeh app ek big trap hai. Yeh basically 7-day short-term loan deta hai, jisme interest rates astronomical high hote hain – jaise 30-50% per week ya usse zyada effective rate. Agar repayment miss kar diya, toh heavy penalty, harassment calls, aur even contacts list access karke family ko call karna shuru kar dete hain. Yeh RBI guidelines ke against bhi ho sakta hai, lekin yeh apps loopholes use karte hain.

Kyun Loan112 Par Bharosa Nahi Karna Chahiye? Description Vs Reality

App ka description kehta hai: “Instant approval, no hidden charges, friendly support.” Lekin reality mein, users complain kar rahe hain ki process slow hai, no response, aur charges bahut high. For example, yeh 7-day loan app hai, matlab loan sirf 7 din ke liye, aur agar repay nahi kiya toh interest double-triple ho jata hai. Yeh predatory lending hai, jisme poor people ko target kiya jata hai emergency ke naam par.

Ab aate hain critical reviews par. Hum inko Hinglish mein bata rahe hain taaki Indian audience easily samajh sake. Yeh reviews screenshots se liye gaye hain (jo user ne provide kiye), aur play store se similar patterns milte hain. Har review ko quote kar rahe hain with date aur details.

Critical Review 1: Dushyant Waghmare (1 Star, 12/12/25)

“Common people trust your applications and request for loans in emergencies but did not get the desired response from you. I needed money for some of my emergency work, I used your app hoping to get it from you but there is no response from you, I have completed all the documents, I have also sent you msgs, emails, but still my request is stuck on sanction. are you going to pass the loan after the deadline??”

Hinglish mein: “Aam log aapke app par bharosa karte hain aur emergency mein loan maangte hain, lekin aap se koi response nahi milta. Mujhe emergency work ke liye paise chahiye the, maine aapka app use kiya ummeed se, lekin koi jawab nahi. Saare documents complete kar diye, msgs aur emails bheje, phir bhi request sanction par atak gayi. Kya deadline ke baad loan pass karoge??”

Yeh review ko 10 logon ne helpful mana. Company ka response: “We’re sorry to hear about your experience. Our support team is here to help—please share your issue at care@loan112.com or call +91-8745015338.”

Yeh dikhaata hai ki app response time bahut poor hai.

Critical Review 2: Gaurav Chawla (1 Star, 01/11/25)

“I took a loan and closed it as per required timeline. After that got a message from there representative on new loan offer for which I replied I’m not looking it for now, may be later. He the. If I don’t take loan then he will reject my application. Which I never did for new loan. As this is totally unfair behaviour as this rejection can impact cibil. So be cautious on using this application.”

Hinglish mein: “Maine loan liya aur time par close kar diya. Uske baad unke representative se message aaya new loan offer ka, maine reply kiya abhi nahi chahiye, baad mein dekhunga. Phir usne kaha agar loan nahi liya toh application reject kar dega, jo maine new loan ke liye apply hi nahi kiya tha. Yeh totally unfair hai kyunki rejection CIBIL score ko affect karega. Isliye is app ko use karte time savdhaan raho.”

33 logon ne helpful kaha. Yeh harassment aur unfair practices ko highlight karta hai.

Critical Review 3: Tauhid Ansari (1 Star, 02/12/25)

“Predatory Practices and Harassment! Stay Away. This app is an absolute nightmare and is engaged in predatory lending practices. I strongly advise everyone to avoid it. The interest rates are astronomically high, The customer support is non-existent and unhelpful and unprofessional. The app illegally accessed my contacts list. When I was slightly delayed on a payment, they began calling my friends and family, defaming me and causing immense mental distress and public humiliation.”

Hinglish mein: “Predatory practices aur harassment! Door raho. Yeh app nightmare hai aur predatory lending karti hai. Sabko avoid karne ki salah. Interest rates bahut high hain, customer support bilkul nahi hai, unprofessional. App ne illegally contacts access kiye. Payment thoda delay hua toh friends aur family ko call karke badnaam karne lage, mental distress aur public humiliation.”

39 logon ne helpful mana. Company response same: Sorry, contact us.

Yeh serious issue hai – contacts access aur harassment, jo illegal hai India mein.

Critical Review 4: Ivaneenura k (1 Star, 05/10/25)

“I applied for a loan and repaid it on time. Later, I applied for a re-loan, but the process is still incomplete. They assigned me a credit manager, but he hasn’t answered my calls. I have sent multiple follow-ups and emails, but I haven’t received any response from his side. I applied for the loan due to an emergency, but there has been no response. If we miss an EMI, they call and email multiple times, but even after repaying on time, I didn’t get any response regarding my re-loan.”

Hinglish mein: “Maine loan apply kiya aur time par repay kiya. Baad mein re-loan apply kiya, lekin process abhi tak incomplete. Credit manager assign kiya, lekin calls ka jawab nahi deta. Multiple follow-ups aur emails bheje, koi response nahi. Emergency ke wajah se apply kiya, lekin koi reply nahi. Agar EMI miss kiya toh bar bar call email karte hain, lekin time par repay karne ke baad bhi re-loan ka koi response nahi.”

62 logon ne helpful kaha. Company: Sorry for delay.

Critical Review 5: Nikitha Anthony (1 Star, 07/12/25)

“I tried applying for a loan on the app and also spoke to my credit manager who provided all the necessary documents but he kept asking for the Owner’s E bill or Gas Bill which is unnecessary. I’ve tried several apps in the past but did not face any difficulty. You would need to change the terms in f asking owner’s details after providing all the ID and Address Proof I’m totally disappointed..”

Hinglish mein: “Maine app par loan apply kiya aur credit manager se baat ki, saare necessary docs diye, lekin woh owner’s E-bill ya Gas Bill maangta raha jo unnecessary hai. Pehle kai apps use kiye, koi problem nahi hui. Terms change karo, ID aur address proof dene ke baad owner’s details kyun? Totally disappointed.”

33 logon ne helpful.

Critical Review 6: Anonymous (1 Star, 18/12/25)

“They say it fast and reliable but what kind of standards are they setting when they can’t provide you solution within 24 hours . My credit manager phone is still not reachable plus when contacted customer they ask me to wait for another 24 hours and always in a hurry to drop the call when i can’t get loan on time what’s the use very disappointing plus whoever drops the review over here same answer is provided with contact customer or drop a mail but still no response”

Hinglish mein: “Kehte hain fast aur reliable, lekin 24 hours mein solution nahi de sakte toh kaise standards? Credit manager ka phone unreachable, customer care se baat ki toh aur 24 hours wait bolo, call jaldi drop karte hain. Time par loan nahi mila toh kya fayda? Bahut disappointing, aur reviews par same answer – contact customer ya mail karo, phir bhi no response.”

25 logon ne helpful.

Critical Review 7: TS FAMILY SALON (1 Star, 13/10/25)

“This app seems to be collecting our personal documents. I applied for a loan 3 days ago But i didn’t get any reply. And I have been waiting for the last 3 days, i need an emergency and even sent multiple emails to customer support but i didn’t receive any reply, Worst app, profile displayed as 100% completed but my status of application still in application in review from last 3 days, Don’t use this app.”

Hinglish mein: “Yeh app personal documents collect karne ke liye lagta hai. 3 din pehle apply kiya, koi reply nahi. Emergency hai, multiple emails bheje customer support ko, koi jawab nahi. Worst app, profile 100% complete dikhaata hai, lekin application review mein atak gayi 3 din se. Mat use karo is app ko.”

150 people found helpful? Wait, 150 nahi, prompt mein 150 nahi hai, galti se. Anyway, helpful hai.

Inke alawa, play store par similar reviews hain jahaan users bolte hain ki app data collect karta hai, lekin loan nahi deta, ya phir repayment par harass.

There are some positive reviews too, jaise Sourav Majumder (5 stars): “The Loan112 Instant Personal Loan App is truly amazing! The process is super fast, simple, and completely hassle-free. I got my loan approved and credited within minutes without any hidden charges or unnecessary documents. The customer support is friendly and helpful, making the whole experience smooth and trustworthy. Highly recommended for anyone who needs quick financial help.”

Lekin yeh positive reviews fake lagte hain ya sponsored, kyunki critical ones mein patterns same hain – no response, harassment.

Loan112 Ke Heavy Charges Aur 7-Day Trap Ki Asliyat

Yeh app 7-day loans deta hai, matlab short term, lekin interest 20-40% per week effective. Example: 10,000 loan liya, 7 din baad 12,000 repay – yeh 20% interest! Miss kiya toh penalty add, aur calls shuru. RBI ke according, NBFC apps ko regulate kiya jata hai, lekin yeh apps Chinese funding wale hote hain sometimes, jo illegal tactics use karte hain.

Common issues:

- High Interest: Astronomical rates, hidden fees.

- Harassment: Contacts access, family calls, defamation.

- No Response: Application stuck, credit manager unreachable.

- Data Privacy Breach: Illegal access to phone data.

- CIBIL Impact: Unfair rejections affecting score.

Agar aap is app ko use kar rahe ho, toh immediately uninstall karo aur RBI ya police se complain karo if harassed.

Alternatives To Loan112: Safe Loan Options

Better options:

- Bank apps jaise SBI YONO, HDFC Quick Loans – low interest, safe.

- Legit fintech jaise Paytm Money, MoneyTap – RBI approved.

- Government schemes jaise Mudra Loan for small needs.

Hamesha check karo app RBI registered hai ya nahi.

Tips To Avoid Such Loan App Scams

- Play store rating mat dekho, reviews padho.

- Interest rates calculate karo pehle.

- Permissions check karo – contacts access mat do.

- Emergency mein family se help lo, app se nahi.

- Complain karo cyber cell mein if harassed.

FAQs About Loan112 Credit Loan App

Q1: Loan112 app safe hai kya?

A: Nahi, bahut complaints hain harassment aur high charges ki. Critical reviews se door raho.

Q2: Loan112 mein interest rate kitna hai?

A: Officially nahi batate, lekin users kehte hain 30-50% effective for 7 days, bahut heavy.

Q3: Agar loan miss kiya toh kya hoga?

A: Heavy penalty, calls to family, CIBIL kharab.

Q4: Loan112 se loan lene ke liye documents kya chahiye?

A: Aadhaar, PAN, bank details, lekin woh extra maangte hain jaise owner’s bills.

Q5: Better alternative kya hai?

A: Banks ya RBI approved apps use karo, jaise Cred, Slice.

Q6: Harassment ho raha hai, kya karun?

A: Police ya RBI Ombudsman se complain karo, proof rakho calls ke.

Umeed hai yeh article helpful hua. Share karo agar kisi ko bachana hai!